Wintod payroll calculator

The CRA online payroll calculator uses a simple tax calculation method. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Avanti Income Tax Calculator

Payroll Payment Date DDMMYYYY.

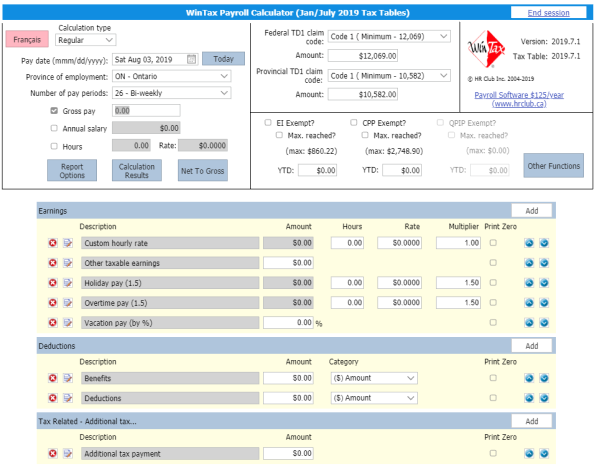

. The salary calculator is a great tool when hiring employees. WinTax Calculator from HRIS Consulting is a free tool for calculating Canadian payroll taxes. Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization.

Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees. Employees Benefits Local and global benefits for remote teams. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

Form TD1-IN Determination of Exemption of an Indians Employment Income. Use this tool to. Here When it Matters Most.

Get Your Quote Today with SurePayroll. Payroll So Easy You Can Set It Up Run It Yourself. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld.

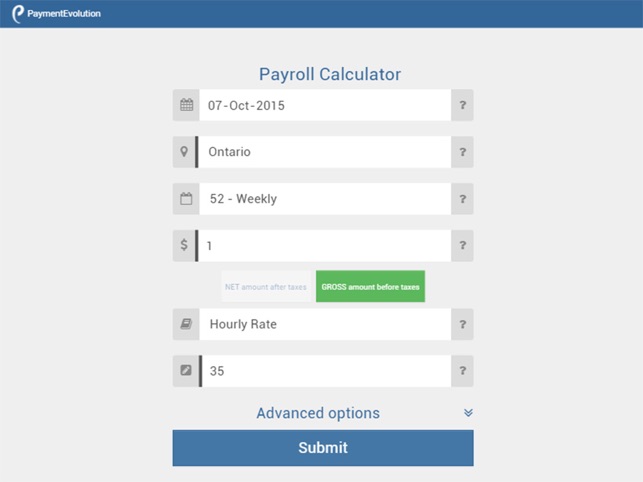

Our all-new webTOD calculator is now HTML5 compatible and will run on any browser-enabled device. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Advanced Mode Quick Calculator.

Global Payroll Calculator Choose the country. Find 10 Best Payroll Services Systems 2022. Estimate your federal income tax withholding.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. It can determine your tax on your salary bonuses commissions and retroactive. Featured Wintod free downloads and reviews at WinSite.

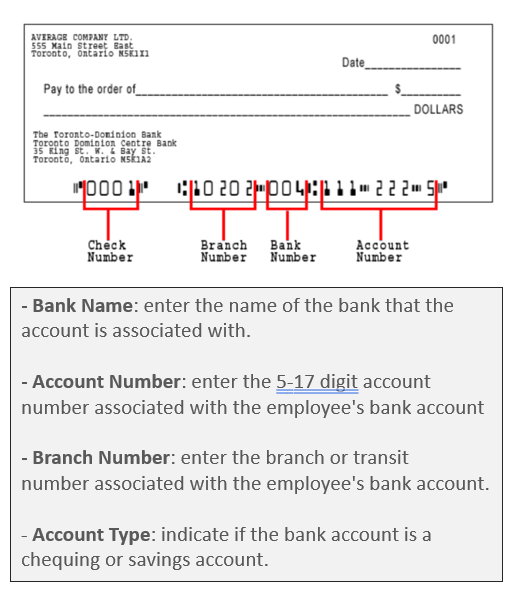

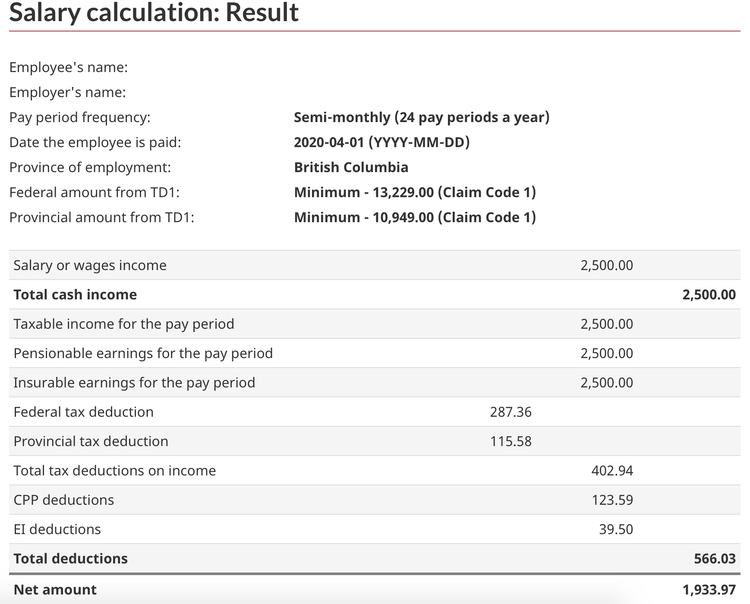

Heres a step-by-step guide to walk you through. Run Global Payroll Pay your employees with a few clicks. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Ad Process Payroll Faster Easier With ADP Payroll. Plug in the amount of money youd like to take home. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

Get Started With ADP Payroll. Affordable Easy-to-Use Try Now. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Discover ADP Payroll Benefits Insurance Time Talent HR More. TD1 Total Claim Amount.

Get Started With ADP Payroll. It will confirm the deductions you include on your. WebTOD webTOD is a free online Canadian Payroll Tax Deductions calculator.

Featured Wintod free downloads and reviews at WinSite. Ad Compare This Years Top 5 Free Payroll Software. See How Paycor Fits Your Business.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. As an alternative to Canada Revenue Agencys PDOC payroll calculator WinTax is designed especially for small businesses and new payroll users. TD1 Total Claim Amount.

See how your refund take-home pay or tax due are affected by withholding amount. View Gross-Up Payroll Calculator Calculate gross pay based upon take. Ad Compare This Years 10 Best Payroll Services Systems.

Take a Guided Tour Today. Ad Get Started Today with 2 Months Free. Prov Of Employment.

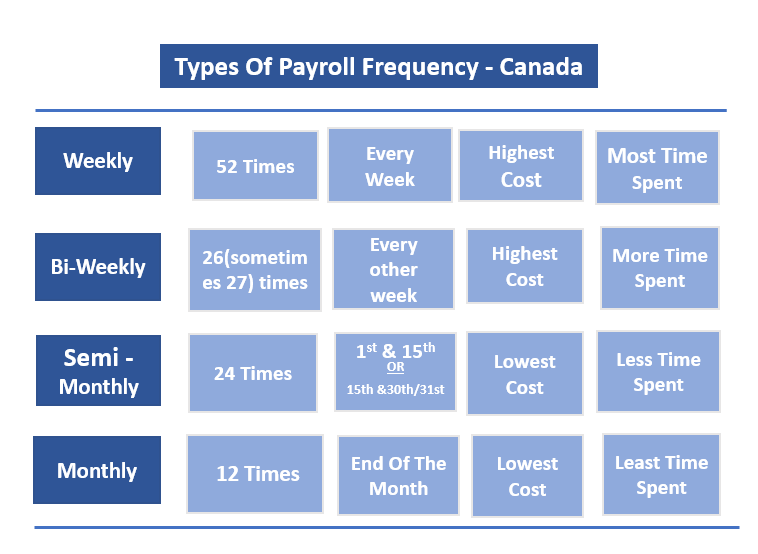

Federal Salary Paycheck Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Ad Process Payroll Faster Easier With ADP Payroll.

Customized Payroll Solutions to Suit Your Needs. Free Unbiased Reviews Top Picks. The standard FUTA tax rate is 6 so your max.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Free Unbiased Reviews Top Picks.

For example if an employee earns 1500 per week the individuals annual. It handles calculations for all. The calculator will show you the costs of hiring employees or raising wages and allow you to delve into other employer.

All other pay frequency inputs are assumed to be holidays and vacation. All Services Backed by Tax Guarantee. And Wintod which is program provided by the Canadian government to calculate taxes does not.

Discover ADP Payroll Benefits Insurance Time Talent HR More.

Payroll Calculator Canada On The App Store

How To Calculate Payroll Tax Deductions Monster Ca

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Everything You Need To Know About Running Payroll In Canada

Payroll Calculator Canada On The App Store

Payroll Calculator Free Employee Payroll Template For Excel

Different Types Of Payroll Deductions Gusto

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Mathematics For Work And Everyday Life

What Are The Required Payroll Deductions In Ontario Filing Taxes

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Wintax Calculator Wintax Canadian Payroll Software

Everything You Need To Know About Running Payroll In Canada

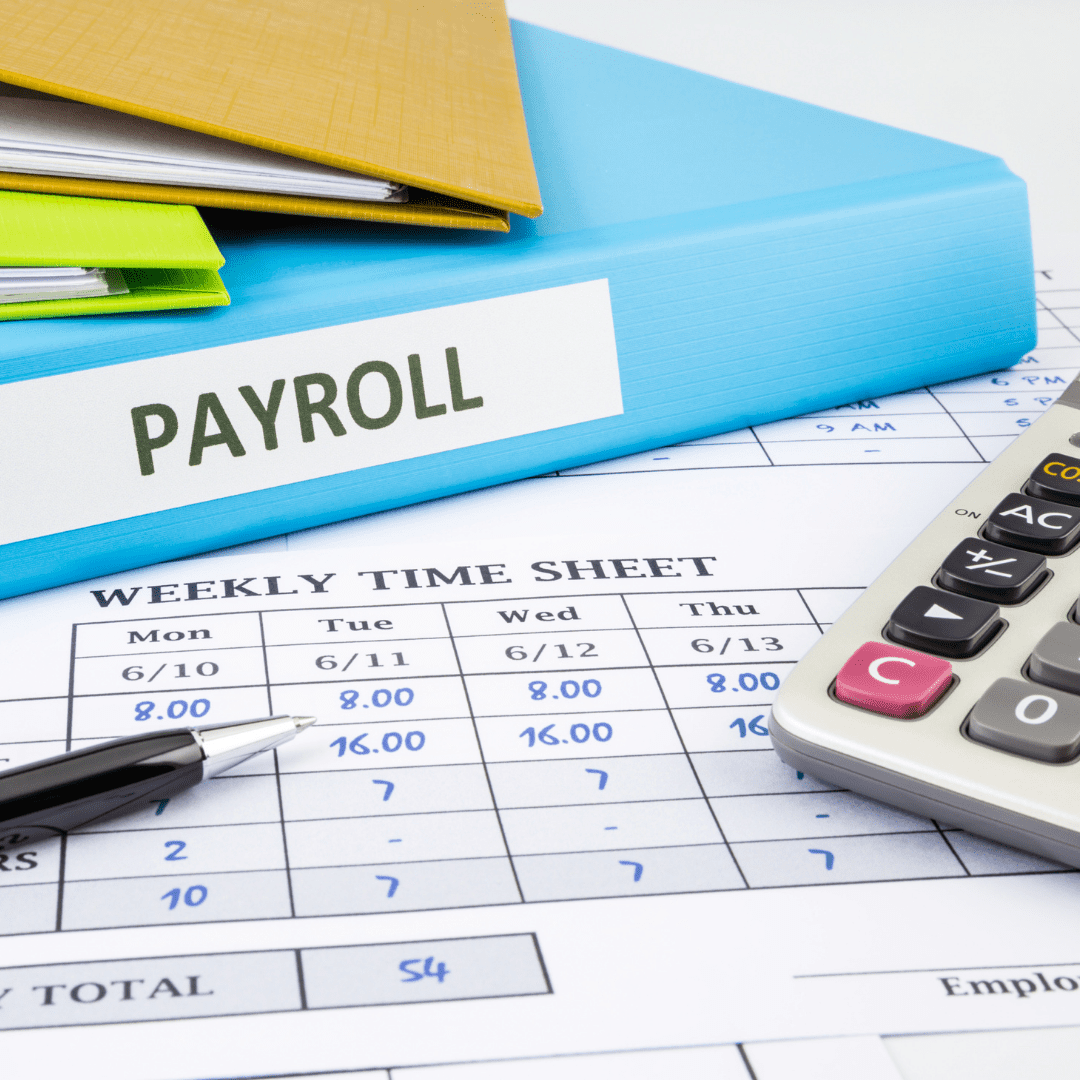

How To Do Payroll In Canada A Step By Step Guide

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Canadian Payroll Tax Deductions Guide Youtube